Visualise your bountiful business exit

Visualise your bountiful business exit, it’s worth it. Einstein considered imagination to be more important than intellect. Before doing an actual experiment, he would visualise the experiment in his mind, thinking about each and every detail and the whole sequence. As a result, he was prepared for the minor or major problems that he could encounter during the experiment. Establishing your business takes a lot of effort. It is only fair for you to consider a bountiful exit when selling your running business. However, like everything else, a business sale also requires a proper strategy. If you are well prepared, your business sale will conclude smoothly, with maximum returns for your hard work. The best way to be prepared for a business sale is to visualise successful business exit.

Visualise your bountiful business exit, it’s worth it. Einstein considered imagination to be more important than intellect. Before doing an actual experiment, he would visualise the experiment in his mind, thinking about each and every detail and the whole sequence. As a result, he was prepared for the minor or major problems that he could encounter during the experiment. Establishing your business takes a lot of effort. It is only fair for you to consider a bountiful exit when selling your running business. However, like everything else, a business sale also requires a proper strategy. If you are well prepared, your business sale will conclude smoothly, with maximum returns for your hard work. The best way to be prepared for a business sale is to visualise successful business exit.

Visualising the Solicitor

A good advisor can make the difference between a successful or stalled business sale. Apart from looking at qualifications and experience, you should also visualise yourself to be working together with your solicitor —preparing a sales pitch, drafting a Memorandum, finalising Heads of Terms, and most importantly, negotiating. Try to imagine what working with your advisor will be like. This will help you in choosing the solicitor that you feel most comfortable working with.

The solicitor I chose was a word of mouth recommendation. When we first met, he spent quite some time with me outlining my options, explaining the process and cover potential costs. During our discussions I felt that he was genuine, straightforward and able to help me get what I wanted. As the sale process progressed I often visualised leaving my solicitors office with a big smile. And towards the end I pictured myself hugging my solicitor (and he’s not really the huggable type)! Looking back now, I remember the day clearly when I got up from the boardroom table, concluding the deal and wraping my arms around my solicitor. What a great day!

Visualising the Sales Pitch

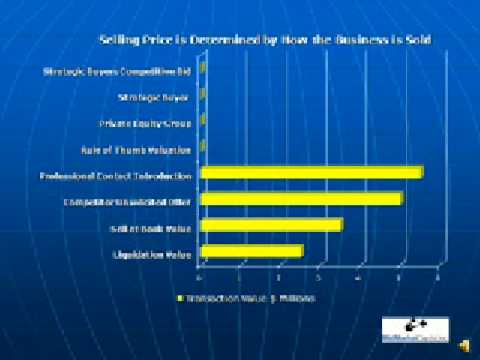

The sale proposal is the first thing that you are going to need. It is also known as a Memorandum of Information. The memorandum should be prepared very professionally and should be a lucrative document for the buyers. It should emphasise the strengths of your business, and underplay the weaknesses. But, everything should be done artfully. You can improve the impact and quality of your document by adding graphs, charts and other data that looks credible. Try visualising that you’re that the buyer rather than the seller. Think about the points that you, as a buyer, would like to see in the Memorandum. Your solicitor will also give you valuable advice, but it’s you who should be calling the shots rather than just towing the line that your solicitor gives you.

Visualising Meetings

You’ll be required to attend many meetings with the buyer’s team, during which you’ll be asked to explain different parts of your business. Before the pre-completion day, there may be a number of negotiation sessions to finalise the prices, payment terms, and other terms and conditions of the sale. Visualising each such meeting beforehand will make you better prepared to handle them.

Never show that you are desperate to sell your business. In fact, you should give the impression that there are other buyers also interested in buying your business. Remember that a delayed sale is usually a declined sale; therefore, you must do everything to speed up the sale process. Do not be available for meetings too readily. It might make the buyer think that they are the only party interested in your company. Rather, schedule appointments for meetings and inquire about the agenda beforehand. Some companies launch a media campaign just before they send out a sale memorandum, so as to improve the image and the potential price of their business. Visualising a successful business exit is about visualising each one of the activities right until the pre-completion day point.

Visualising Negotiations

For negotiating the terms and the price, you should first sit together with your business sale team and your business broker. Brainstorm your priorities about the price, and know the limit to which you can show flexibility to. Identify the weaker aspects of your business and be ready to answer tough questions. Remember, that your buyer will focus on the weaknesses of your business in an effort to reduce the price. You should be prepared for the counterarguments. You can either focus on your strengths and show that they offset your weaknesses, or you can find ways to underplay your weaknesses and convince the buyer that the price that you are demanding is profitable for them. Visualise negotiations always ending on a positive note where both you and the buyer walk away satisfied.

Visualising Indemnities, Warranties and Representations

The most sensitive aspects of a business sale are the representations, warranties and indemnities that you provide in your documents. A representation is a statement about a certain fact or aspect of your business. By giving a representation, you are taking responsibility that the information that you are providing is true and authentic. Similarly, the warranties that you issue are assurances about some aspects or assets that they have been correctly stated. Any wrong information from your side for which you have provided a warranty, will put you in the breach of the sale agreement. Indemnities are also similar; however, while indemnifying your buyer, you are taking responsibility to compensate the losses that the buyer may suffer in case a particular term of the agreement is breached by you.

Before issuing indemnities, warranties or representations, you should visualise the ramifications of issuing these documents or including these clauses in the sale agreement. It is best to keep the warranties and indemnities to a minimum. And when you do have to issue them, make sure that they should not keep troubling you even after you have sold your business.

Finally, you can visualise having a vacation at your favourite destination after you have successfully exited from your business. Do this from the start!

If you’re approaching an imminent completion day, have a look at our Completion Day Checklist. It’s provides everything you need to know and do for the big day.

Kim Brown, Co-Founder of Business Wand, helps business owners navigate their way through the start to finish process of selling a business. Her specialty is to help owners cut costs and increase profits prior to sale. To understand how you can sell your business quickly for the highest sales price, purchase the book, “How To Sell A Business: The #1 guide to maximising your company value and achieving a quick business sale”

Starting a new business all over again? What about your existing business? There can be many reasons for selling a business. It may be that you have realised that you are in the wrong line of business, and would like to switch industries. Or, you might have realised that your business is not performing as expected, and you would rather sell your business while it’s still making some profits. After all, over 50% of business start ups go under in the first five years. And, if you are lucky, you have a business that’s roaringly successful, and you would like to cash in the good will and start up a new business.

Starting a new business all over again? What about your existing business? There can be many reasons for selling a business. It may be that you have realised that you are in the wrong line of business, and would like to switch industries. Or, you might have realised that your business is not performing as expected, and you would rather sell your business while it’s still making some profits. After all, over 50% of business start ups go under in the first five years. And, if you are lucky, you have a business that’s roaringly successful, and you would like to cash in the good will and start up a new business.

A business can be only as good as the people it employs. When taking care of your business, it takes a lot of effort and time to establish it on firm ground and along the way you build up a number of assets. These assets can be tangible, like computers, furniture or stocks. But, it’s the intangible assets that are usually the most important. These intangible assets are your goodwill and your human resource. When you decide to exit your business and are planning to sell it, it is vital that you retain key staff right until the key moment.

A business can be only as good as the people it employs. When taking care of your business, it takes a lot of effort and time to establish it on firm ground and along the way you build up a number of assets. These assets can be tangible, like computers, furniture or stocks. But, it’s the intangible assets that are usually the most important. These intangible assets are your goodwill and your human resource. When you decide to exit your business and are planning to sell it, it is vital that you retain key staff right until the key moment.

How could my company be valued 7x more than another valuation?

How could my company be valued 7x more than another valuation?

Negotiation Techniques to Use When Selling Your Business

Negotiation Techniques to Use When Selling Your Business

The Business Exit Void

The Business Exit Void

Guess what honey – I’m Selling My Business

Guess what honey – I’m Selling My Business