Top 5 tips when starting a new business all over again

Starting a new business all over again? What about your existing business? There can be many reasons for selling a business. It may be that you have realised that you are in the wrong line of business, and would like to switch industries. Or, you might have realised that your business is not performing as expected, and you would rather sell your business while it’s still making some profits. After all, over 50% of business start ups go under in the first five years. And, if you are lucky, you have a business that’s roaringly successful, and you would like to cash in the good will and start up a new business.

Starting a new business all over again? What about your existing business? There can be many reasons for selling a business. It may be that you have realised that you are in the wrong line of business, and would like to switch industries. Or, you might have realised that your business is not performing as expected, and you would rather sell your business while it’s still making some profits. After all, over 50% of business start ups go under in the first five years. And, if you are lucky, you have a business that’s roaringly successful, and you would like to cash in the good will and start up a new business.

Start-up business owners usually have little experience of managing their own business. After they have done it for some time, the level of their awareness about the market and the industry is improved. Two years down the line, their vision improves significantly and they can spot opportunities better. For instance, let’s say you have a website that’s also making money. However, by virtue of your experience, you know that another niche is driving more traffic and could deliver more profits. You can always dispose of your existing business without making a loss, and hopefully for a big profit, and start a new business that appears more lucrative to you.

Here are five tips from highly successful entrepreneurs to guide you through the business-switching process.

1. Do Not Jump the Boat

Switching between businesses is like switching between boats. If you jump off one onto other, there are chances that you might end up landing in the cold water. Do not try to start a new business while you are still running your old one. This will require you to be disciplined in your thinking and actions. Once you are focused on a new business, you may get distracted and your old business may suffer in the process. You might not be able to concentrate on the sale of your old business and may lose money selling it a in a hurry. Also, your new business might also suffer because you would not be devoting full time and attention to it. The key is to do one thing at a time. Once you are convinced that you should be going for a new business, concentrate on selling the old business first. This will free important time and financial resources that you can devote to building your new business start up.

2. Devote Time and Attention to Planning

Starting a business is a difficult decision to make. It’s not something that you do in haste. It’s better to devote proper time and attention at each and every stage of the planning process. If, and we don’t hope such is the case, you are regretting to be in a certain line of business, it might be because you did not make a great plan. Dreaming is okay, but your dream must translate into facts and figures through careful planning. How will you finance the start up business costs? What will be your marketing plan? How will you manage the workload? What are your goals in 1 year? 3 years? What is your vision of your business? These are all questions you must ask yourself, and do not move ahead until you have put down every little detail into your laptop.

The problem here is, for many people who are looking to sell their business and venture on a new start up business, there may not be enough time to plan. Urgency may exist because the old business might be consuming too much time or returning too little profit, or both. Under such situations, do the best you can to make the transition smooth.

3. Evaluate the Business you are looking to Start

You’ll need to be 100% sure that the new business that you are looking to start is not all glitter and no gold. Remember that the grass always seems greener on the other side. So, make sure that you talk to a few people in your new line of business. Gather facts and figures about your target market. Evaluate whether the market would be growing in future. You should be careful not to get caught in a fad and be left high and dry when the excitement of the fad runs out.

4. Keep Marketing in the Centre

SMEs are at the centre of the British economy, providing over fifty-nine per cent employments in the country. At the centre of any successful SME, though, is a robust marketing strategy. Marketing is around what your new business should be built. You should start by profiling your target market. Think about the need that your product satisfies; then, think about the people who have that need. Ask yourself: what do my customers do to satisfy their need at present? How can I make a difference? That’s where marketing starts. From there onwards, you should think about the media that your customers watch, the places that they go to, and the product attributes that matter to them. After you have achieved clarity about what you need to do, focus on “how”. Think about the skills and resources that you’d require in order to meet the needs of your target market.

5. Learn from Your Old Business

Apply the learning from your old business to your new business. As Einstein said, “insanity is doing the same things over and over again, expecting different results”. You should be doing everything right the second time. However, you’ll need proper monitoring and constant evaluation of your performance in order to be able to apply corrections to your business strategy. Make sure you have a system for monitoring and evaluation in place in your business plan.

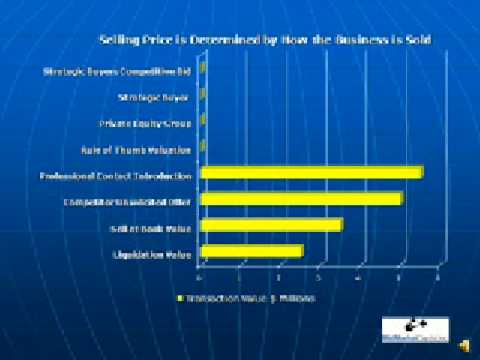

Lastly, (but as a matter of fact, firstly), you need to sell your old business profitably. This should be your priority, because you want to capitalise on the time and the efforts that you have invested in your old business.

Business start up is not easy to set up but you’ve done it once before so it should be easier the second time around!

Kim Brown, Co-Founder of Business Wand, helps business owners navigate their way through the start to finish process of selling a business. Her specialty is to help owners cut costs and increase profits prior to sale. To understand how you can sell your business quickly for the highest sales price, purchase the book, “How To Sell A Business: The #1 guide to maximising your company value and achieving a quick business sale”

The Business Exit Void

The Business Exit Void

Selling your business – Define your life after selling a business so you know your aiming for

Selling your business – Define your life after selling a business so you know your aiming for